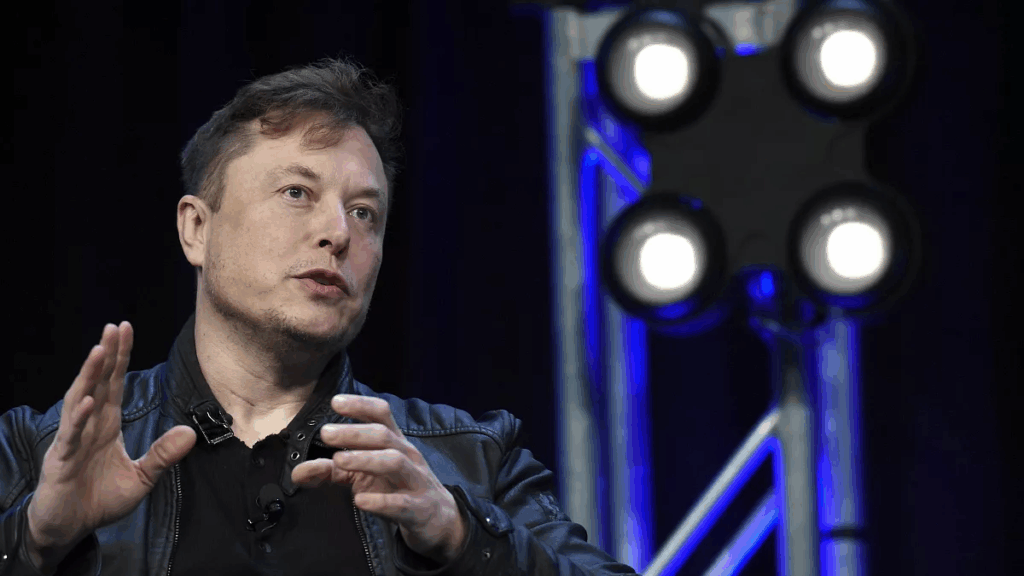

In Just Hours, a Major Incident Erases $44 Billion of Elon Musk’s Net Worth, Dealing a Heavy Blow to the Billionaire

Breaking News: Elon Musk’s Fortune Takes a Historic Hit Amid Public Feud

In a dramatic turn of events on June 5, 2025, Elon Musk, the world’s richest individual and CEO of Tesla and SpaceX, saw his net worth plummet by a staggering $44 billion in a single day, marking one of the largest single-day wealth losses in history. The catastrophic drop was triggered by a high-profile public feud with U.S. President Donald Trump, which sent Tesla’s stock into a tailspin and wiped out $150 billion in the company’s market capitalization. This unprecedented financial blow has sparked widespread debate about Musk’s influence, Tesla’s future, and the volatile intersection of politics and business.

The Spark: A Public Clash with Trump

The incident began when Musk took to X to criticize a GOP-backed spending bill, dubbed the “Big, Beautiful Bill,” warning that it could trigger a recession by late 2025. His outspoken opposition drew a fierce response from President Trump, who accused Musk of opposing the bill due to the removal of electric vehicle (EV) tax credits that benefit Tesla. Trump escalated the situation, threatening to terminate government contracts with Musk’s companies, including SpaceX’s lucrative deals, estimated to be worth $38 billion. Musk fired back, claiming he was instrumental in Trump’s 2024 election victory and even threatening to decommission SpaceX’s Dragon spacecraft.

The public war of words, played out across X and Trump’s Truth Social, quickly spiraled. Posts on X captured the intensity, with one user noting, “$TSLA dropped 10%, and Musk’s wealth shrank by $26 billion in hours. This Trump-Musk feud is shaking Wall Street!” Another post reported Tesla’s stock plummeting 14.3%, erasing $150 billion in market value. According to the Bloomberg Billionaires Index, Musk’s personal fortune fell from $368 billion on June 5 to $335 billion by the end of June 6, a loss of $44 billion when factoring in additional declines in his private enterprises.

Tesla’s Troubles Amplified

Tesla was already grappling with challenges before the feud erupted. The company reported a 71% plunge in first-quarter profit and a 20% decline in vehicle sales in 2025, with some consumers boycotting the brand due to Musk’s controversial political involvement. The public spat with Trump exacerbated these issues, as investors grew wary of the political risks tied to Tesla’s reliance on government contracts and EV subsidies. The stock’s 14% drop on June 5 was the largest single-day decline in Tesla’s 15-year history as a public company, pushing its market cap below the $1 trillion mark.

Analysts point out that Musk’s wealth is heavily tied to his 12% ownership stake in Tesla, making him particularly vulnerable to the company’s stock fluctuations. The ripple effects of the feud could also impact Musk’s other ventures, such as SpaceX and xAI, which rely on government partnerships and investor confidence. As one X post warned, “This isn’t just about Tesla. If Trump targets Musk’s contracts, SpaceX could take a hit too.”

Industry and Public Reactions

The Musk-Trump fallout has ignited a firestorm of reactions. Some industry observers see this as a self-inflicted wound for Musk, with former Tesla employee Matthew LaBrot stating, “Elon only has himself to blame.” Others argue that Musk’s role as a former special government employee in the Department of Government Efficiency (DOGE) gave him unprecedented influence, but his abrasive style alienated key allies. A nonpartisan analysis estimated that DOGE’s cost-cutting measures, led by Musk, may have cost taxpayers $135 billion due to inefficiencies like mass firings and rehiring of federal workers.

On X, sentiment is mixed. Some users rallied behind Musk, with one posting, “Elon’s fighting for what he believes in, but this feud is costing him billions. Worth it?” Others criticized his recklessness, with a post stating, “Musk’s ego just cost him $44B. Maybe he should stick to building cars.” The political media has also been abuzz, with outlets describing the feud as a “disaster of epic proportion” for Tesla and Musk’s empire.

What’s Next for Musk and Tesla?

The fallout raises serious questions about Musk’s next moves. Will he double down on his criticism of Trump, risking further retaliation, or seek to mend ties to stabilize Tesla’s stock? Trump’s threat to cancel government contracts could have far-reaching consequences for SpaceX, which relies on NASA and military partnerships. Meanwhile, Tesla faces mounting competition in the EV market, with brands like BYD and Rivian gaining ground.

Musk’s pivot away from politics to focus on his companies, including the upcoming Tesla Starlink Pi Series set for 2026, could help restore investor confidence. However, the damage from this feud may linger. As Bloomberg noted, the $44 billion loss doesn’t fully account for potential declines in Musk’s private enterprises, meaning the true impact could be even greater.

Conclusion

In just hours, a heated public dispute with President Trump erased $44 billion from Elon Musk’s net worth, underscoring the fragility of wealth tied to volatile markets and political entanglements. While Musk remains the world’s richest person with a fortune of $335 billion, this historic loss serves as a stark reminder of the risks he faces as a polarizing figure. As Tesla navigates choppy waters and Musk’s empire hangs in the balance, the tech world is watching closely to see how this saga unfolds.

What do you think about Musk’s clash with Trump? Share your thoughts!

Sources: Information compiled from posts on X and articles from Bloomberg, CNBC, and Vanity Fair. Note: Some details remain unconfirmed and are based on public sentiment and reports as of June 13, 2025.